Heartland Sees Revenue Declines of 3% in Quarter

Heartland’s third-quarter consolidated top line fell 3% year over year, while revenue before fuel surcharges declined 4%; slightly behind our expected run rate for the full-year 2013. Management indicated that rates improved, but “inconsistent” freight demand, limited driver availability, and the government’s recently revised hours-of-service rules weighed on tractor utilization. We expect these factors to be a common theme reported by most truckload carriers for … Continue reading Heartland Sees Revenue Declines of 3% in Quarter

The mystery behind Google barges

Mysterious barges appeared in the ocean near Google's basement. The software giant said nothing about the strange construction, until now. See what is behind the barges!Read More >> Continue reading The mystery behind Google barges

World's larges video rental closed

Blockbuster has closed its gates. The video business is dead. But what is the history behind the scenes? And what is the next step in related fields?Read More >> Continue reading World's larges video rental closed

Caltex Reports Significant First Half Declines

Caltex reported a 13% decline in first-half 2013 replacement cost net profit to AUD 171 million, in line with expectations. Revenue fell 2.5% to AUD 23.6 billion due to lower sales volumes and lower average prices. Marketing and distribution earnings before interest and tax, or EBIT, was in line with the record first-half 2012 result of AUD 367 million, as lower sales were favourably offset … Continue reading Caltex Reports Significant First Half Declines

ASM Lithography Meet Street Expectations

ASM Lithography reported third-quarter results that were within the range of our expectations. We are maintaining our fair value estimate and moat rating. For the quarter, revenue was EUR 1.32 billion, up 11% sequentially, and an increase from sales of EUR 1.23 billion in the year-ago quarter. Sales benefited from improved business conditions and a full quarter of contribution from ASML’s recent acquisition of lithography … Continue reading ASM Lithography Meet Street Expectations

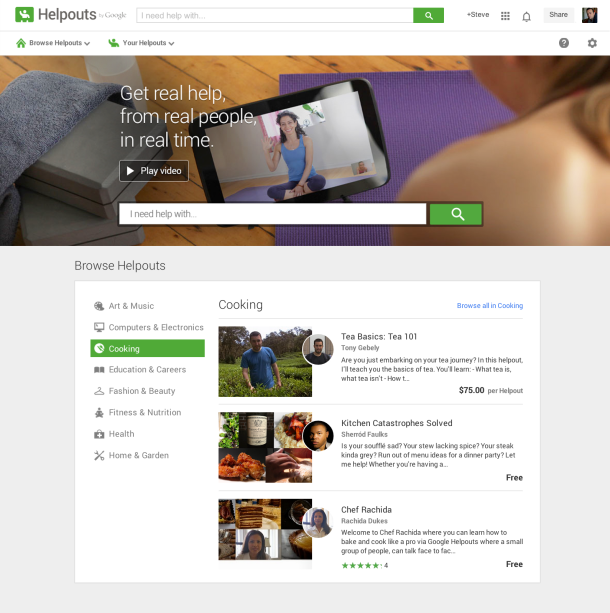

Google Helpouts is leaked

“Get real help from real people” – this is the motto of Google's new product, Helpouts. Users are going to be able to browse video answers of other users, and enables you to videochat with those, who can solve your problem.Read More >> Continue reading Google Helpouts is leaked